Accounts Payable - Select And/Or Pay Invoices

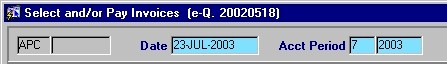

The Accounts Payable - Select and/or Pay Invoices routine allows the user to select Invoices for full or partial payment, to place payment of Invoices on hold, and to post Invoice payments. When the user executes their query, all Invoices will be returned and displayed in the order of the user's choice. From the query results, the user must 'mark' which Invoices are to be paid or held. Invoice payments can then be posted or saved to be posted at a later time or date. When the AP Select Invoices for Payment routine is accessed from the eQuinox main menu, the screen shown below will be displayed.

Field Definition

The first two fields on this screen display the Journal Type (APC) and the Journal Number.

Date - The date on which the Invoice is being selected for payment. This field automatically defaults the current system date.

Acct Period - The Month (in number format) and Year of the Firm's current Accounting Period. This field automatically defaults to the current Accounting Period. Note: Depending on the Firm's preferences (as indicated in the Firm Parameters routine), the user may be alerted with a message when posting the Invoice Payments, and asked to verify the Accounting Period; this is used to ensure that all transactions occur within the correct Accounting Period.

Firm Bank - The General Ledger Account to which the Invoice Payments will be posted (i.e. the money to make the payments will be drawn from this account). A selection may be made from the List of Values provided.

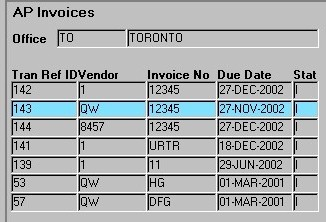

Ap Invoice Details

The screen sections seen below display the Accounts Payable Invoice details. When the user first enters this section, they must select the way in which the records are to be displayed (i.e. Sort By) and then execute their query. All Invoices will be returned in the query results, displayed in the order specified by the user. From the query results, the user must make the necessary Payment or Hold selections. Invoices can be selected, and these selections saved and then payments posted at a later date, or the Invoices can be selected and the payments posted all at once. The Invoice details displayed are as entered in the Accounts Payable - Post Invoices routine.

Office - The unique identifier and name of the Office for which the user is viewing invoices. This field defaults to the Office associated with the current user.

Tran Ref ID - The Transaction Reference Identification number. This number is automatically assigned by E-Quinox in the AP Post Invoices routine, and is used to identify the Transaction, not the Invoice itself.

Vendor - The unique identifier of the Vendor associated with the current Invoice (i.e. the Vendor who sent the Invoice to the Firm), as entered in the AP Post Invoices routine. The Vendor Number will be displayed in this field, and the Vendor Name will be displayed below.

Invoice No - The Invoice number, as entered in the AP Post Invoice routine. This is the number that appears on the Invoice itself.

Due Date - The date by which payment of the Invoice must be made.

Stat - The status of the current Invoice. The meanings of the various status abbreviations that may be displayed in this field are as outlined below.

"PF" - The Invoice has been paid in full.

"PP" - The Invoice has been partially paid.

"F" - The Invoice has been marked for full payment, but the payment had not yet been posted.

"P" - The Invoice has been marked for partial payment, but the payment has not yet been posted.

"H" - Payment of the Invoice has been placed on hold.

"I" - The original status of an Invoice, assigned when entered through the AP Post Invoices routine.

"RV" - The Invoice has been reversed.

Note: If Invoices have been reversed or paid in full, they will be disabled, and the user will not be able to make changes to these records.

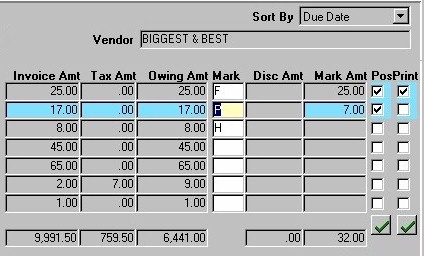

Sort By - Before executing their query, the user must select the order in which invoices will be displayed. A selection may be made from the dropdown list provided. Valid options are sorted by Due Date (which is the default if no selection is made), Invoice Number, Transaction Reference ID, and Invoice Status.

Vendor - The name of the Vendor associated with the current invoice. This field changes automatically as the user selects different records.

Invoice Amt - The total dollar amount the Firm must pay for the current Invoice (i.e. not including taxes). The total Invoice Amount for all Invoices returned in the query is displayed at the bottom of this column (i.e. 10826.20).

Tax Amt - The total dollar amount in Taxes that the Firm must pay for the current Invoice. The total Tax Amount for all Invoices returned in the query is displayed at the bottom of this column (i.e. 516.80).

Owing Amt - The total dollar amount for both the Invoice and Tax Amounts that the Firm must pay for the current Invoice. If no payments have been made, the full Invoice Amount will be displayed in this field. The total Amount Owing for all Invoices returned in the query is displayed at the bottom of this column (i.e. -88.00).

Mark - This field allows the user to either mark the current Invoice for Full Payment (will display "F"), Partial Payment (will display "P"), or place the Invoice on Hold (will display "H"). A selection may be made from the List of Values provided. If the user marks an Invoice for Full Payment, the full Invoice Amount will be displayed in the Mark Amt field. If the user marks an Invoice for Partial Payment, they must enter the amount of the payment in the Mark Amt field. If the user marks an Invoice as being placed on Hold, they must then enter Hold Payment Details, seen below. The total Marked Amount for all Invoices returned in the query is displayed at the bottom of this column (i.e. 12.00).

Disc Amt - The discount, in dollars, that the Firm received on the current Invoice. Note: When Invoices are paid before a specified Discount Date, the Firm is eligible for a discount off the next Invoice from that Vendor. If a discount appears in this field, this means that the previous Invoice from this Vendor was paid before the Discount Date and a discount has been applied to the current Invoice. The total Discount Amount for all Invoices returned in the query is displayed at the bottom of this column (i.e. .00).

Mark Amt - If an Invoice has been marked for Partial Payment, the user must enter the amount of the payment in this field. If an Invoice has been marked for Full Payment, the full Invoice Amount will be automatically displayed in this field.

Post - To post Invoice payments, the user can either 'check' individual records, or use the "Green Check Mark" button to 'check' all records that have been marked for payment or placed on hold. This feature allows the user to easily select and verify records for posting. To complete the posting process, the user must then click the Save button or press F10 on their keyboard. The user can also exit the routine without posting the payments; those records that were 'marked' will be saved, and can be posted at a later date or time.

Print - To print the current invoice, the user must 'check' this field. To select all records to be printed, the user can simply click the "Green Check Mark" button found below this field. When the information is posted, the invoices selected will be printed to the user's default printer.

Disc Date - The date by which an Invoice must be paid to receive a discount on the next Invoice from this Vendor. This date is automatically displayed, and is calculated based on information at the Vendor level. The information displayed in this field is specific to the currently selected record.

Disc Rate - If the Invoice is paid before the Discount Date, a discount at the rate displayed in this field will be applied to the next Invoice from the current Vendor. The information displayed in this field is specific to the currently selected record.

Description - A description of the current Invoice, as entered in the AP Post Invoices routine. The information displayed in this field is specific to the currently selected record.

Next Record(S) - To view the next record, or the next set of records, the user may click the "down arrow" button that appears below the Post and Print fields.

Hold Payment Details

If the user places payment of an invoice on hold, they must provide the following information.

Authorized By - The unique identifier and name of the Timekeeper who authorized the placement of the current Invoice on hold. A selection may be made from the List of Values provided.

Reason - The user must enter the reason for placing the current Invoice on hold.

Completing the Process

To save 'marked' records without posting the Invoice payments, the user must simply click the Save button (or press F10 on their keyboard) without having checked the Post fields. When the markings are successfully saved, a message will be displayed to the user in the status bar of the form, as seen below.

![]()

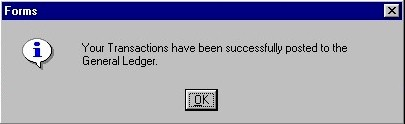

To post Invoice payments, the user must 'check' the Post fields (either individually or using the 'Green Check Mark' button), and then click the Save button (or press F10). When the Invoice Payments are successfully posted, the user will be presented with the message seen below.